Watson Webinar Recap: COVID-19: Effects and Outlook on the Disposable Gloves Supply Chain

We launched our Watson Webinar Series with our first webinar, COVID-19: Effects and Outlook on the Disposable Gloves Supply Chain. Don Kittmer, an expert on disposable gloves, and Christina Yeung, Watson Gloves’ Product Development Manager, helped kick things off.

Did you miss this webinar? You can view the webinar recording or read our recap below. Let’s take a dive and see what these glove experts had to say about the global disposable glove market.

The Market Landscape

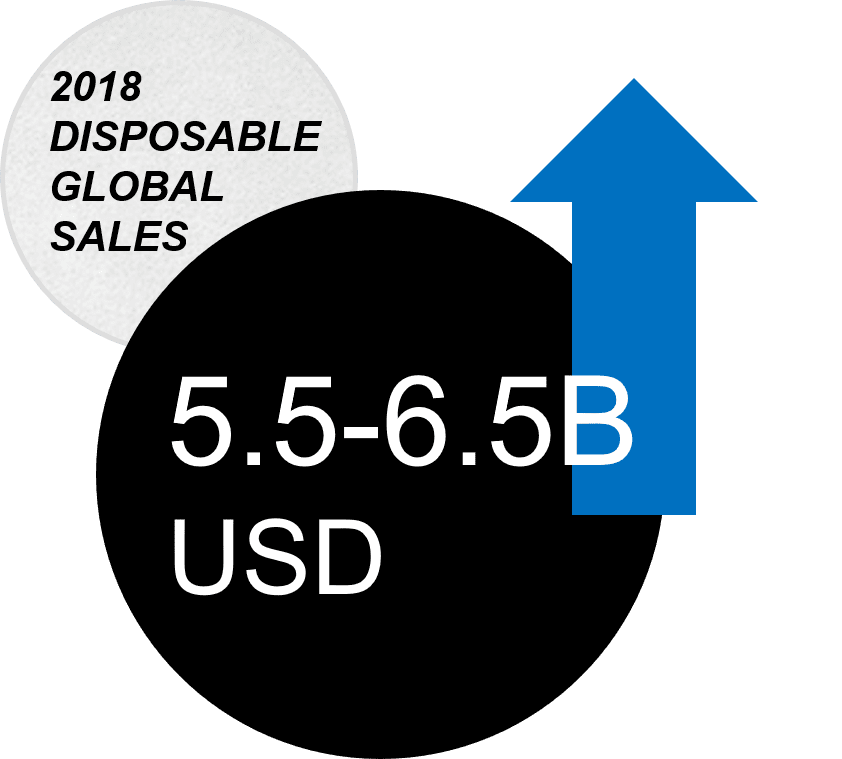

The global market for disposables gloves in 2018 was estimated to be between $5.5 to $6.5 billion USD, which includes both exam and industrial/food service disposable gloves. The volume of disposable gloves continues to rise year after year, even with the current COVID-19 crisis. In fact, the pandemic has brought a greater spike in disposable glove usage, as food, hospital, medical devices and pharmaceutical industries are in greater need of these PPE products and we’re also seeing an increasing usage of it as personal PPE.

The Global Disposable Glove Market was valued at $7.6 billion USD in 2019 and expected to reach $11.8 billion USD by 2025 observing a current annual growth rate of 14% during 2020 and tapering off to around 7% around 2025. With the pandemic spurring sales though, we expect projected growth to exceed predictions.

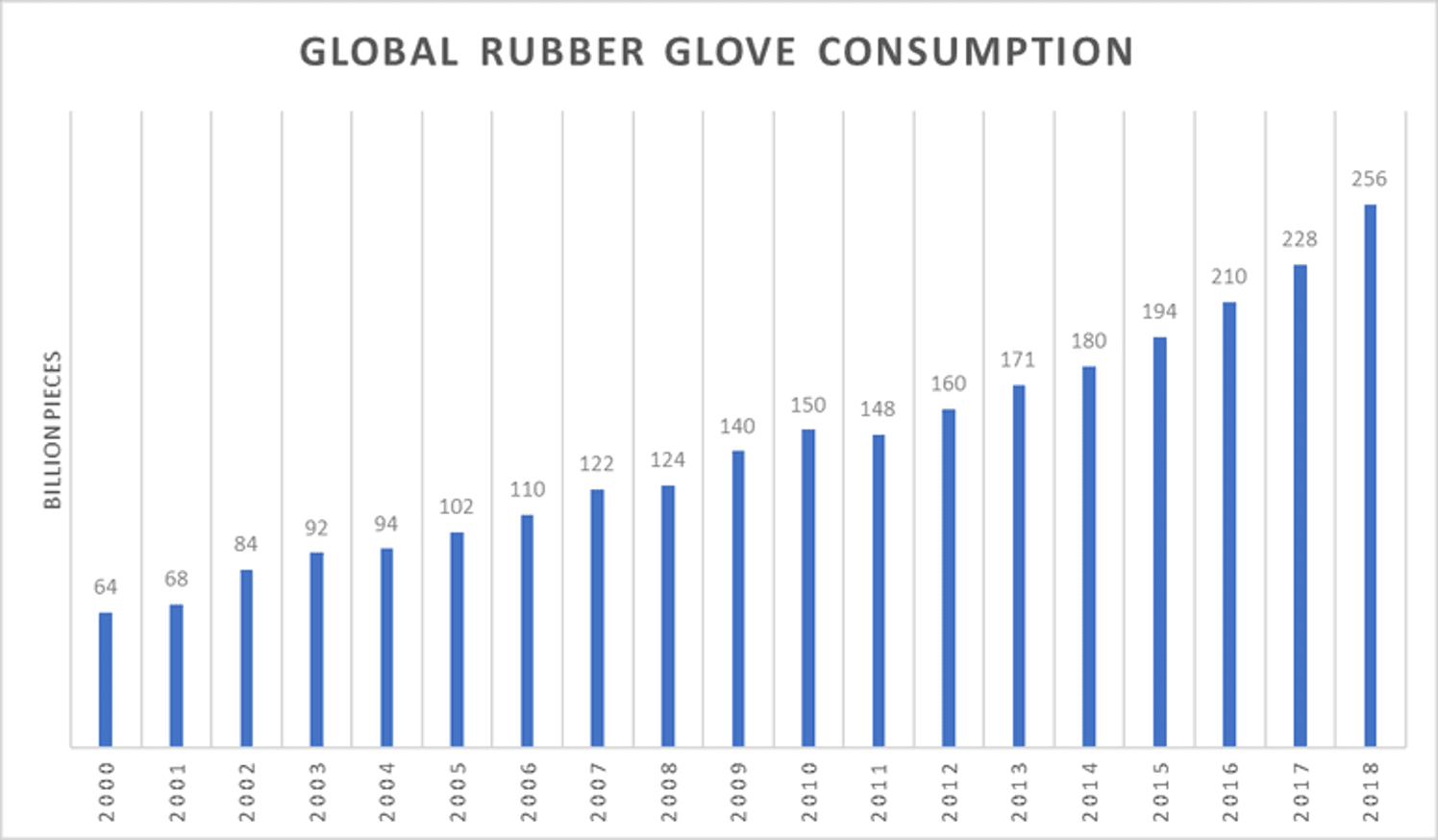

Since 2000, glove consumption has quadrupled from 64 billion pieces to 256 billion pieces in 2018 and records report that 265 billion gloves were produced in 2019. We expect usage to grow in 2020 and onward with expected production volume to be around 330 billion pieces for 2020.

Market Segmentation by Product

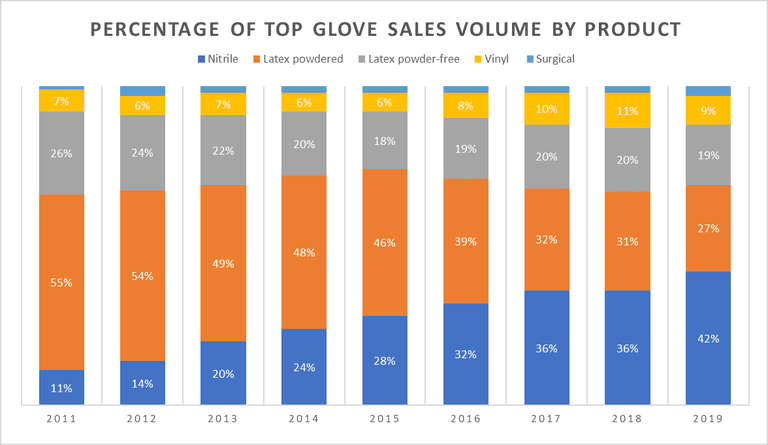

Source: Top Glove annual reports

Over the past few years, we’ve been seeing a shift in the disposable glove market from latex to nitrile being the predominant disposable glove product in the marketplace. In 2017, disposable gloves overtook latex powdered disposable gloves in global sales. And in North America, nitrile glove usage is substantially higher, as powdered latex disposable gloves have been banned for exam use. The share of glove sales for nitrile is closer to 60% to 65% in the North American market. With an increase in public awareness of latex allergies, we can only expect a greater increase in nitrile disposable glove sales.

Key Production Regions

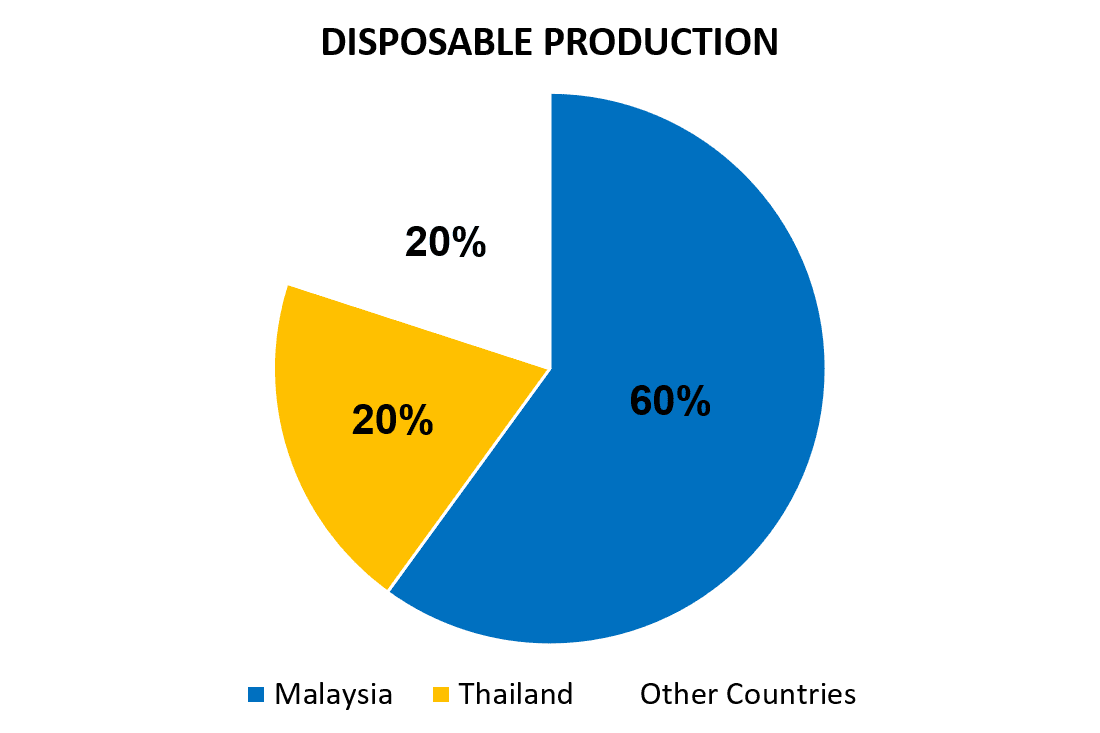

When you look at the production of disposable gloves around the world, most of the gloves are coming out of Asia. Thailand, Indonesia, and Vietnam are the top producers of natural latex rubber. For nitrile butadiene rubber (NBR), manufacturers in Malaysia, Thailand, and Indonesia have the largest market share.

When we look at where disposable gloves are produced, we can see that Malaysia and Thailand together manufacture more than 80% of the latex and nitrile gloves in the world. During the pandemic, these factories are working at capacity and they still can’t meet the current demand. Prior to COVID-19, factories would be running at 75% to 85% capacity. But now, factories are running at 100% capacity due to COVID-19, which is demonstrably challenging on the manufacturers.

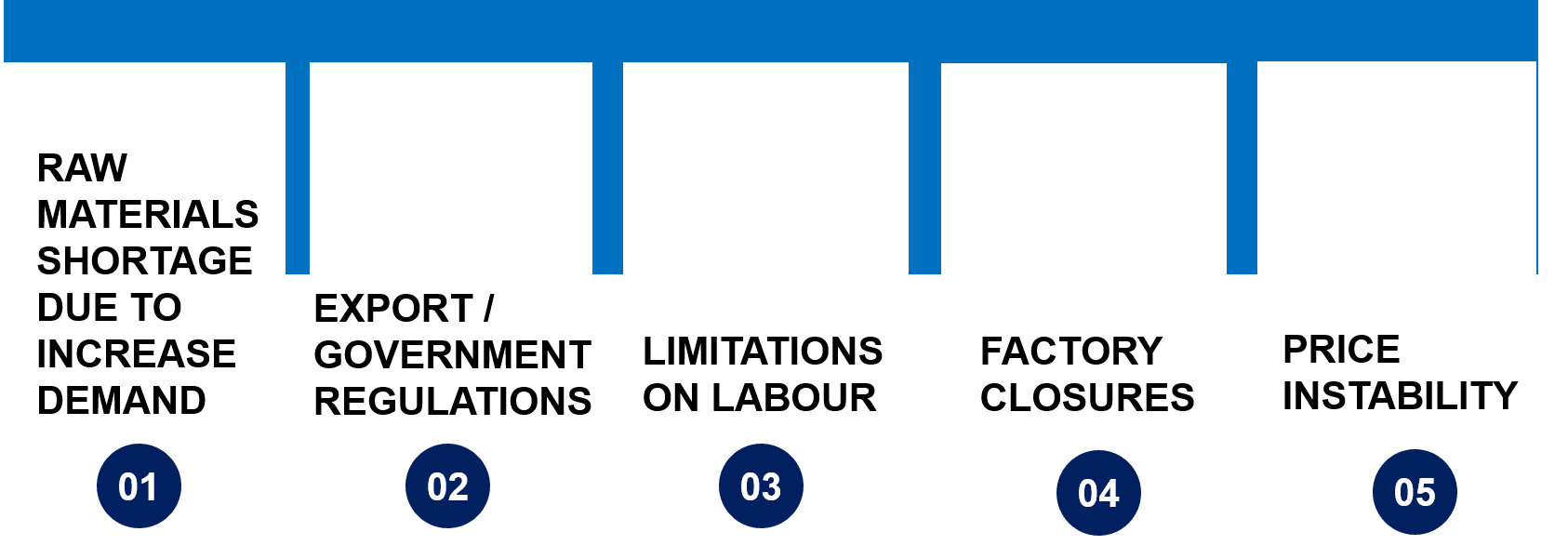

5 Effects on the Supply Chain Due To COVID-19

1. Raw materials shortage due to increase demand

The increased consumption of disposable gloves is the new norm, both on the industrial and personal level. On the personal level, you can witness a higher increase in glove usage, whether you’re going grocery shopping or gas stations, etc. Hospitals, which are receiving an influx of patients and care facilities, which are taking care of the elderly who are at risk, have also contributed to the substantially larger consumption in disposable gloves.

This demand increase causes serious backlog from a lot of manufacturers. Top producers are seeing as high as an 180% increase in orders, and factories are all at capacity. Due to the fear of limited supply, lead time has increased from 40 days to about 400 days in some cases from the time you place your order. The surge in demand has overwhelmed the available supply, which has caused bidding wars between the manufacturers for products and raw materials.

2. Export/government regulations

Currently, government stockpiling is causing some challenges in the supply chain. Countries that have disposable glove manufacturers (Malaysia, Thailand, Vietnam, Indonesia, and China) are limiting what’s being shipped out so they can handle their domestic needs with products, such as disposable gloves.

Greater government control of distribution can be seen with China. There were some early challenges in China during COVID-19 with fraudulent products that didn’t meet quality requirements being shipped out, such as exam-grade gloves, N-95 masks, etc. As a result, China ramped up inspections and implemented additional requirements. This inevitably slows down the release of products from manufacturers. With an increase in inspections when products leave the factory or the port now, products are expected to be delayed until what’s being shipped out is inspected and meets the new standards.

3. Limitations on labour

The lockdown has resulted in movement restriction orders and movement control orders, which is making factories struggle to get skilled workers to meet the demand. Malaysia for instance suspended the intake of new Ford workers until the end of 2020. These government orders have impacted all workers involved in the supply chain – crew on ocean freighters needed to move the product, equipment maintenance, etc.

4. Factory closures

Chinese New Year/Lunar New Year occurred in the beginning of the year just as COVID-19 was unravelling in China and other manufacturing countries. Typically during this time every year, you would expect a 30% reduction in supply availability in China, as workers would travel back home to their home region. However, with COVID-19, the entire country was mostly on lockdown during this time (January-February). This meant workers couldn’t leave home and go back to work. As a result, factories were being shut down for several months, which in turn, resulted in a huge backlog of orders, as orders are now booked out well into 2021.

5. Price instability

With COVID-19 shaking up the entire supply chain, price instability is an inevitable consequence. Raw material prices are fluctuating, such as liquid NBR, due to a bottleneck in production. Several factories producing raw materials also have scheduled downtime to service their equipment, which usually runs for 45 days or more. This significantly reduces the amount of raw materials, such as liquid nitrile, on the market. This puts pressure on other suppliers, which are already running at full capacity.

The bidding war is not just limited to the raw material that’s used to make the gloves. It runs through the entire supply chain, such as transportation, where there’s a high demand for things to be transported, and printing, where there are 1-2 month delays on getting printed materials.

Outlook on the Disposable Glove Market

We can most certainly expect an increase in growth in the disposable glove market due to several factors:

- The potential for a second wave of COVID-19 and the potential of an outbreak from other pandemic diseases

- The growing preference and demand for nitrile gloves

- Growth in clean room technology

- An increased awareness towards personal hygiene

- Increased need for medical examination gloves

Although it looks likes the disposable glove market will continue to flourish in the future, the supply has yet to keep up with demand. The Malaysian Rubber Glove Manufacturers Association expects glove shortage to linger until the end of 2021 based on Malaysian glove makers having an average order backlog of 6-8 months, as well as the growing severity of COVID-19 globally.

Innovative Disposable Glove Solutions

The increase in disposable gloves most certainly influences the way we’re innovating our products at Watson Gloves. With the increased use of personal PPE, we’re seeing a lot of disposable masks and gloves being thrown around and littered. On top of that, litter or not, an increase in consumption comes with more waste.

When we look at different plastics or products that are not treated with any sort of enhanced biodegradability features, we can see many of these common products taking well over 100 years to degrade. Plastic bags can take around 200 to 1,000 years to decompose, plastic bottles take around 450 years to break down, and untreated regular nitrile gloves take 200 years or more to break down in landfills!

Here at Watson Gloves, this is something we seriously want to address, which is why we released our Green Monkey™ line – all Green Monkey™ gloves have enhanced biodegradation in them, which helps them break down in around 10 years in moderate landfill conditions (ASTM D5526).

At Watson Gloves, when we’re developing new products, we’re not just thinking about the beginning of life and how we can bring a new product into the market – we also focus on the end of life of our products as well. When a product is used and disposed of, we want to know how it can affect our communities and our future. When you properly dispose our Green Monkey™ gloves, which are then sent to landfills, our Reclaim™ enhanced biodegradation technology in all of Green Monkey™ gloves helps break the glove down into biogas. Nowadays, our landfills are able to harness the biogas that’s released from degradation, which is then used to create energy and fuel, such as electricity.

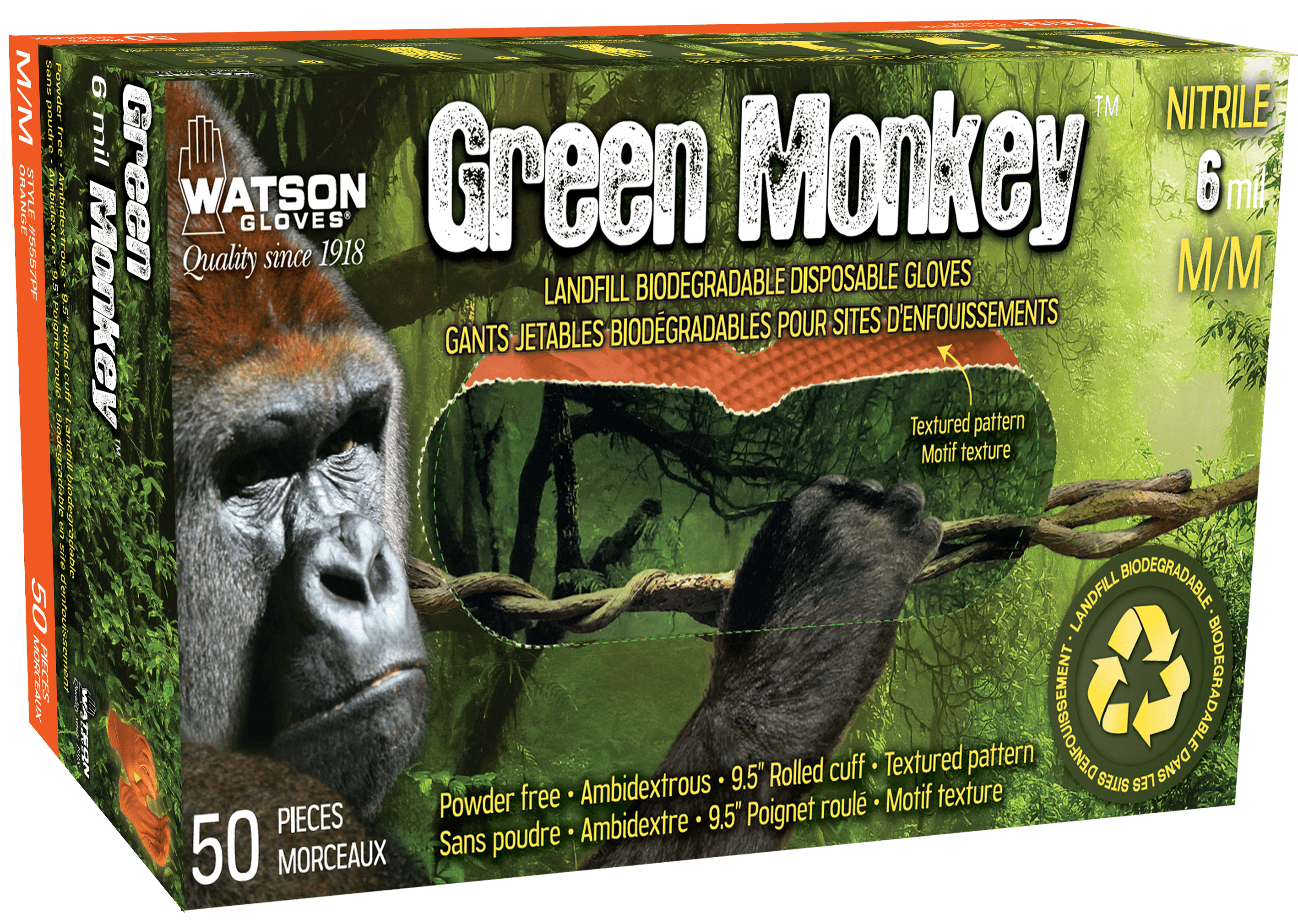

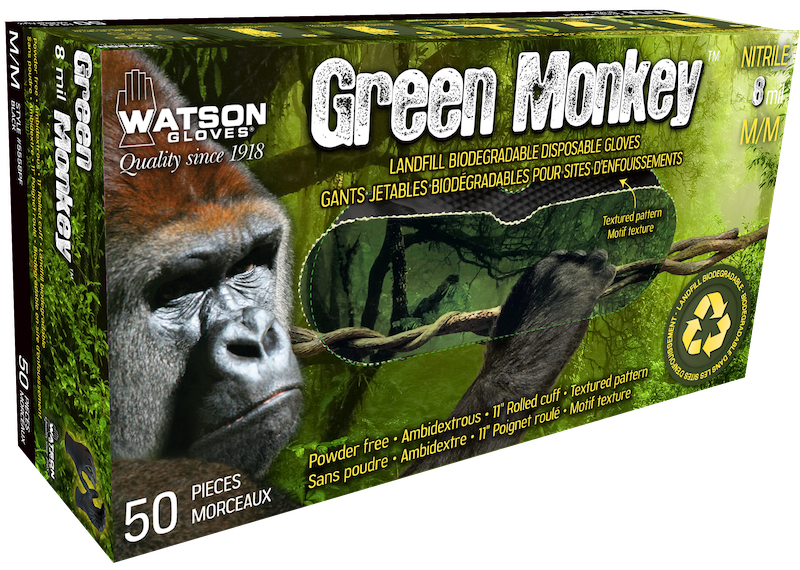

Green Monkey™ – Our Biodegradable Disposable Line of Gloves

Our popular Green Monkey™ gloves, which features the Reclaim™ enhanced biodegradation technology, is the solution for the increase in disposable consumption and waste. A common question asked with these gloves is if the performance and shell life will be affected due to the biodegradability of the glove.

Although the Reclaim™ technology enhances biodegradation, it does not affect the performance or the shelf life of the glove prior to it being disposed of. The technology is only active and starts to biodegrade once the glove is disposed of in proper landfill conditions, such as a certain lack of light and oxygen, a certain amount of moisture, etc. This means performance features of the gloves are just as excellent, if not better, than regular nitrile gloves that have not been treated with enhanced biodegradability treatment.

See our line of Green Monkey™ gloves below. If you want to see all of our disposable gloves, click here.

- Reclaim™ enhanced biodegradation technology

- 4 mil powder-free nitrile

- Chemically resistant to oils, solvents and grease

- Lightly textured and offers great dexterity

- Also in 20-pack

- Reclaim™ enhanced biodegradation technology

- 6 mil heavyweight powder-free nitrile

- Raised textured pattern for sure-grip in oily and wet applications

- Formerly 5557PF Monkey Wrench

- Reclaim™ enhanced biodegradation technology

- 8 mil heavyweight powder-free nitrile

- Raised textured pattern for sure-grip in oily and wet applications

- Also in 10-pack

A Future of Certainty and Uncertainty

One thing is for certain – the disposable glove market will continue to grow, as we see an increase in usage both on the industrial and personal level. But with the explosion in demand, largely due to the pandemic, there has been a lot of uncertainties in the supply chain, such as longer lead times with orders, factories at full capacity, and government regulations and fluctuations of the market affecting the transportation and prices of goods.

When we look towards a future of greater disposable PPE usage, it is important to not ignore the large environmental impact disposable waste will have on the planet. Watson Gloves has been taking initiative in the glove industry in its sustainability efforts by launching biodegradable Green Monkey™ disposable gloves in 2019. And we’re continuing to push the fold by adding Reclaim™ enhanced biodegradation technology to more and more of our products in the future.

If you’re a dealer or distributor ordering disposable gloves, such as ours, please ensure to book in advance. As mentioned, factories are at capacity and lead times are pushed back, so orders, as a result, will also be delayed.

And with face masks, we’re making reusable, cotton fabric face masks right in our Burnaby, BC factory. Instead of using disposable masks, consider using reusable face masks and support local by getting our Canadian Made Face Masks.

Ensure to contact your Sales Rep or speak to one of our Customer Sales Rep via live chat (found on our red live chat bubble on the lower right hand corner) to book your Watson Gloves PPE today.

View all of our webinars, including past ones, such as this one, here.

Sign up for our newsletter!

Stay up to date with the latest Watson Gloves news, releases, and industry updates by signing up to our newsletter!